Capitalizing on Change: 3 Trends Shaping PE & VC Today

Capital Call - a bi-weekly newsletter from LPs for LPs, covering the latest and greatest from across the private markets

Welcome back and thanks for joining me (John Bailey, Co-Founder at OneFund) for the second edition of Capital Call. The newsletter from LPs for LPs.

The mission with Capital Call remains: delivering concise, top-notch insights and updates from the private markets tailored to what matters for LPs.

If you are a new subscriber, make sure to check out our most recent newsletter in which I share some insights from McKinsey’s 2023 Private Markets Outlook.

This week I’ll dive into a few trends currently shaping the PE & VC industry along with news and perspectives from leading GPs.

Subscribe now and stay ahead of the curve with OneFund.

3 Trends Shaping PE & VC Today

Here are 3 trends that are significantly impacting private market opportunities today and likely for the years to come. We'll specifically examine each trend from the perspective of prospective LPs as we think through their implications.

“How do these trends impact how one might think through making venture and private equity investments?”

1. High Levels of Dry Powder

Bain’s recent 2023 Global PE Report revealed that as of Q4 2022, over $3.7T in capital is sitting with funds awaiting investment. This is a massive amount of money sitting on the sidelines that could have seismic impacts on valuations.

More dry powder means more competition for deals. This means not only heightened pressure on GPs to deploy capital but also more dollars chasing a limited number of quality deals. Even as we have seen multiples come down recently, this risks exerting future upward price pressure which could impact fund returns.

As an LP in this sort of environment, it's important to remain aware of how much dry powder a fund has. If a GP has significant capital on hand and is already raising another fund, it can create misaligned incentives to deploy capital quickly in order to move on to investing the successor fund. Also, it becomes increasingly important to remain keenly aware of which GPs are able to get access to competitive deals. As more dollars chase fewer opportunities, ensuring access to GPs with quality track records is increasingly important.

2. Increasing Interest Rates

While there’s been speculation for months that rate hikes will stop, it seems the Fed isn't going to end the interest rate train in the immediate future. There’s a high likelihood we will be facing a high-interest rate environment in the coming years. This will significantly impact private markets.

When it comes to rates, what are some of the most critical considerations for LPs deploying capital?

Funds will find it more expensive and challenging to use leverage. According to Pitchbook, some of the largest LBOs in 2023 were financed with a debt ratio of only 10-50%, well below the typical 60-80% range.

A high-interest rate environment is unfavorable for tech companies who have to discount future earnings more aggressively. If rates continue to rise, this can make it challenging for numerous tech-focused strategies

LPs will continue to find it more expensive to employ leverage in their own portfolios compared to just a couple of years ago

When considering deploying capital to funds, ask yourself:

Does the fund have a track record of generating strong returns in a non-zero interest rate environment or generating strong returns without significant use of leverage?

3. Growing Capital Flows to Impact Funds

As of 2021, the total global impact fund AUM reached over $1T. Something not quite as clear given the short track record of these managers is:

“Will these funds actually outperform other private market strategies?”

It’s a natural law of physics that you cannot optimize two things simultaneously - in this case impact and returns. Given this, one thing we ask ourselves when due diligencing impact funds is: “Why is this fund an impact fund?”

“Is it an area where the firm believes they have a competitive advantage?”

“Is it an area where the founding partners have deep sector-specific expertise?”

If the answer to these questions is a strong yes, it becomes more reasonable to believe the team can drive returns. There are plenty of sector-specific funds that do great, why can’t they also be in climate tech? But if the fund appears to be riding secular trends buffeting impact funds, that’s concerning.

If you enjoyed this read and have any questions or would like to discuss further, feel free to schedule a call with us - we’re happy to chat.

Updates from Across the Ecosystem

Fundraising

📈 Braemont Capital Closes Inaugural Fund at $525M

📈 Ares targets $5B in rollout of Pathfinder fund

Reports

🔬 Bessemer Venture Partners: State of the Cloud 2023

GP Perspectives

Logan Bartlet (Managing Partner, Redpoint Ventures)

Last month, Redpoint Ventures released its LP AGM presentation, which is a great behind-the-scenes look into how a venture firm is reading current market conditions. These presentations are rarely shared with outside audiences so when I came across this last week, I thought it would be great to share with our readers. Some notable insights include:

Venture Fundraising Outlook

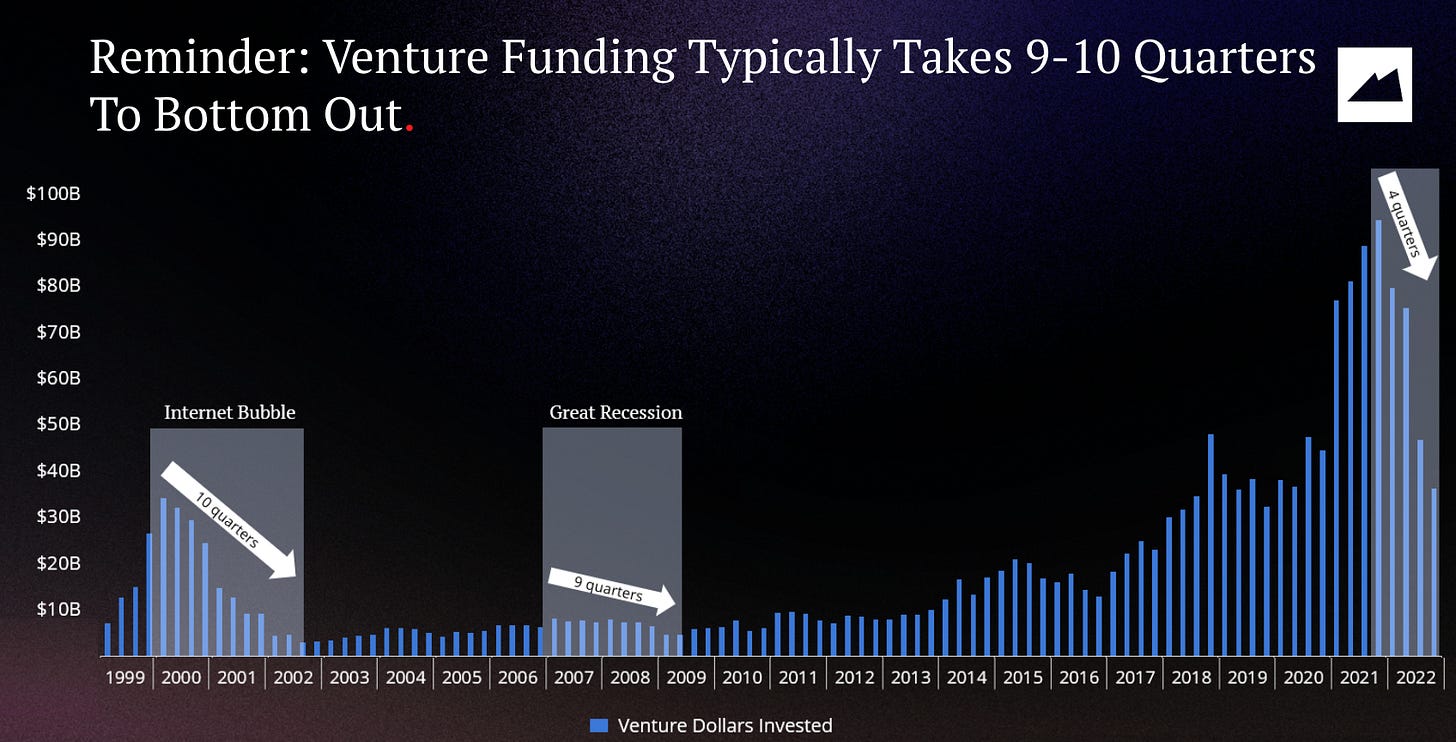

The presentation highlighted how long it ‘typically’ takes from peak venture dollars in the technology market to eventually bottom out. For both the great recession and the internet bubble, it took between 9-10 quarters and currently, we are 5 quarters into this cycle.

History may not repeat itself, but if it does it will ultimately be 4-5 quarters before venture dollars raised bottoms out. If future market environments mirror the internet bubble or the great recession, we could see a meaningful pullback from current levels.

Early versus late-stage valuation impacts

During the current pullback, Redpoint believes that early-stage valuations have corrected a lot quicker than series B+, specifically for software deals. The reason for that being the supply coming to market on the later-stage deals was very limited compared to early-stage fundraising. This ultimately led to a limited number of data points and relatively low supply, as opposed to early-stage deals which were often forced to fundraise due to cash crunches.

(Henry McVey, KKR)

📖 The Role of Private Equity in the ‘traditional’ Portfolio

In his latest thought piece, KKR Partner Henry McVey highlights the role Private Equity can play in a diversified portfolio and looks at the potential trade-offs LPs may want to consider as they think about optimizing returns across a variety of economic environments.

The report notes that PE typically has the strongest relative performance when public equities falter. In all the regimes studied over several decades, PE has on average delivered excess returns of about 4.3% on a net annualized basis and relative performance has tended to be best in choppier markets.

The punch line is that Private Equity, similar to Private Credit and Real Assets, can be quite additive to traditional investment portfolios, especially for investors who are concerned about inflation and/or do not face meaningful near-term liquidity constraints.

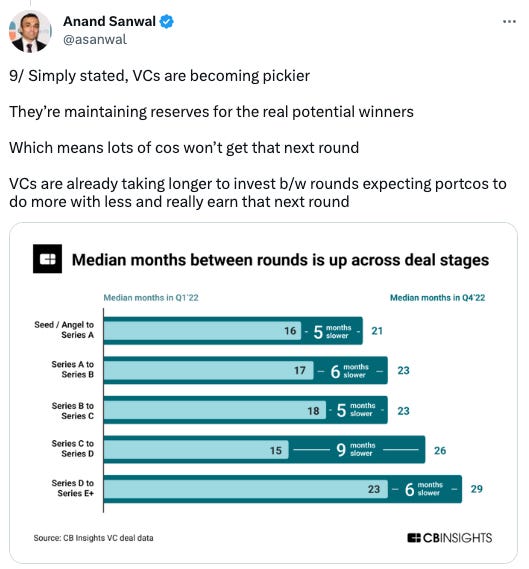

Anand Sanwel (CEO, CB Insights)

Anand Sanwal, CEO of market data platform CB Insights did a great job at breaking down the first and second-order implications of the SVB crisis.

Given this, many tech private equity firms will be salivating at the opportunity to pick up solid yet distressed tech startups for pennies on the dollar, which may present an opportunity for LPs looking to deploy capital with relevant tech-focused managers.

About OneFund

OneFund is democratizing access to Private Equity and Venture Capital for everyday investors. We partner with the world's top PE & VC funds to offer investment options without the million-dollar minimums.

If you would like to follow what we are doing, get more regular updates directly from the team, or access to the platform, you can join our waitlist below!